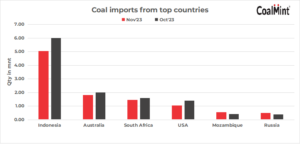

Coal vessel arrivals at Indian ports dropped by 11% m-o-m in the first half of November 2023 (1-15 November) to 10.84 million tonnes (mnt), CoalMint’s vessel line-up data showed.

Out of the total imports in the first half of November, volumes of Indonesian coal were the highest at 5.05 mnt. Some major trading companies that bought Indonesian coal were Adani Enterprises (1.41 mnt) and Adani Power (0.84 mnt). About 3.47 mnt are expected to be imported in the second half of this month.

In India, pockets of demand were seen for Indonesian coal as mills are returning to the market after the festive season and traders starting purchases in anticipation of a rise in prices.

Indonesian coal importers (1-15 November, 2023)

Shipments from Australia drop

India’s imports of Australian coal were recorded at 1.39 mnt. Tata Steel was the top buyer at 0.40 mnt followed by SAIL and Tata Power at 0.26 mnt and 0.17 mnt respectively. About 1.39 mnt of Australian coal are expected to arrive at Indian ports in the second half of November.

Australian coal importers (1-15 November)

Shipments from South Africa drop

Shipments from South Africa were recorded at 1.44 mnt in the period under review, dropping by 9% m-o-m as against 1.58 mnt in the same period in October. Adani Enterprise was the largest importer at 0.19 mnt.

Indian buyers are taking a cautious approach, expecting additional price corrections. This caution has limited trading activities, with buyers hesitant to commit to fixed-price deals. As a result, there is a reduction in inquiry rates, leading to a deceleration in actual transactions within the spot market. Sellers, responding to this buyer’s resistance over current price levels, are implementing measures to avoid accumulating excess cargoes, indicating a potential stabilisation in the near term.

About 0.97 mnt of thermal coal are expected to be shipped in the second half of this month from South Africa.

Other exporters

Shipments from the US dropped by 24% to 1.05 mnt in the period under review compared to 1.39 mnt in the first half of November. Shipments from Mozambique recorded a rise of 34% to 0.55 mnt compared with 0.41 mnt in the same period in October.

Outlook

It is anticipated that imports may drop in the near future amid tepid demand and rising domestic production. Additionally, improved supply and ample availability of Australian coal might exert an upward pressure on imports.