The Purchasing Managers’ Index (PMI) in China’s steel sector, an economic indicator for the industry, fell to 45.6 in October, according to the latest data released by the China Steel Logistics Professionals Committee (CSLPC). The figure was 0.2 percentage point lower than the previous month and remained within the contraction range, indicating weak activities in the steel sector.

The index for production dropped 1.6 month on month to 43.4 in October, down for the third month in a row. Tepid demand, emerging steel production cut and suspension policies, and thin profits even losses contributed to lower production.

New order index witnessed a rise of 0.5 to 44.5, marking a two-month sequential increase but still in the contraction zone for four months, indicating the lower-than-expected buying interests from downstream users.

CSLPC expects steel demand to moderately rebound in November. Steel production and raw material prices are predicted to continue the decline, while steel prices are likely to hover at a low level.

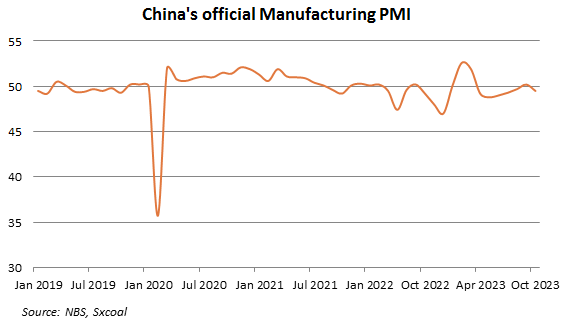

China‘s manufacturing activity fell unexpectedly in October, snapping a rise for four consecutive months since May, mainly hit by a weeklong holiday that affected production and sales.

The official manufacturing purchasing managers’ index (PMI) stood at 49.5 in October, down from 50.2 in September, data from the National Bureau of Statistics (NBS) showed on October 31. The 50-mark separates expansion from contraction in activities. The eight-day “Golden Week” holiday in early October provided a significant boost to travel and tourism, revitalizing these sectors. However, it has had adverse effects on factory production.

Subindex for new orders stood at 49.5 this month, down from 50.5 in September. This implied diminished demand this month. Likewise, new export orders fell from 47.8 to 46.8. The production subindex fell from 52.7 to 50.9, which still stood above the 50 mark, suggesting the production was expending despite at a slower pace. The official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, dropped to 50.6 in October from 51.7 in September, still within the expansion zone.

The official composite PMI, which includes both manufacturing and services activity, dropped to 50.7 from 52.0 a month earlier, indicating a general contraction in China‘s overall production and business activities.

“China’s economic activity fell to an extent, and the foundation for a continued recovery still needs to be further solidified,” NBS senior statistician Zhao Qinghe said in a statement accompanying the release.