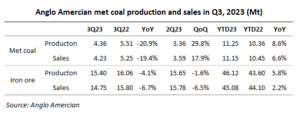

Global miner Anglo American produced 4.36 million tonnes of metallurgical coal in the third quarter of 2023, falling 21% year on year but rising 30% from the previous quarter, its latest quarterly production report showed.

The company sold 4.23 million tonnes of met coal during the same period, down 19% year on year but rising 18% from the preceding quarter.

The lower production was impacted by challenging strata conditions at the Moranbah longwall operation and the ramp-up of Grosvenor during July following the longwall move in Q2. This was partially offset by higher production from the Capcoal open cut operation and the Aquila longwall.

During July-September, Moranbah produced 946,000 tonnes of met coal, down 38% year on year but steady compared with the previous quarter. Output from Grosvenor was registered at 5.60 million tonnes, surging 133% year on year but falling 56% from a quarter earlier. Aquila’s met coal output was 1.34 million tonnes, 16% and 53% higher respectively compared with the preceding year and the previous quarter.

During the first three quarters, the company’s accumulative met coal production rose 9% year on year to 11.25 million tonnes, and sales increased 7% to 11.15 million tonnes.

The average sales price was $264/t, lower than the benchmark price of $284/t.

The company targets to produce 16-19 million tonnes of met coal for the whole year of 2023, with unit cost guidance unchanged at $105/t.

In the third quarter, Anglo American’s iron ore production was 15.40 million tonnes, down 4% year on year and 2% from Q2; iron ore sales were 14.75 million tonnes, falling 7% year on year and 7% from the previous quarter, according to the report.

The total iron ore production stood at 46.12 million tonnes during the first nine months, up 6% year on year. Sales came in at 44.10 million tonnes, up 2%.

Production guidance for iron ore is unchanged at 57-61 million tonnes in 2023, Anglo American said.